New York State Tax Credits Solar Power

Real property tax credit.

New york state tax credits solar power. The system must also be installed and used at your principal residence in new york state. First you don t have to purchase your system to claim the credit i e. New york state solar tax credit with a solar ppa. Guidance on determining federal and or new york state tax credit eligibility.

Solar incentive and financing options. New york state tax credit. A similar tax credit is available at the state level for systems up to 25 kilowatts in capacity. Solar energy system equipment credit.

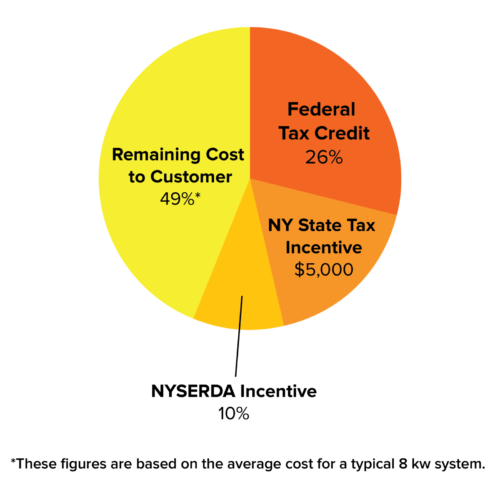

For instance if your system costs 15 000 you d be able to take a 3 750 tax credit on your state taxes. Maryland s is 1 000 per system plus 30 percent of the cost to install a giant battery to store the energy that s produced. New york offers a state tax credit of up to 5 000. If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

New york s residential solar tax credit is equal to 5 000 or 25 percent of the cost of your solar system whichever is less. The solar energy system equipment credit is not refundable. If your property isn t ideal for solar panels or you are not a homeowner community solar may be right for you. How much is the credit.

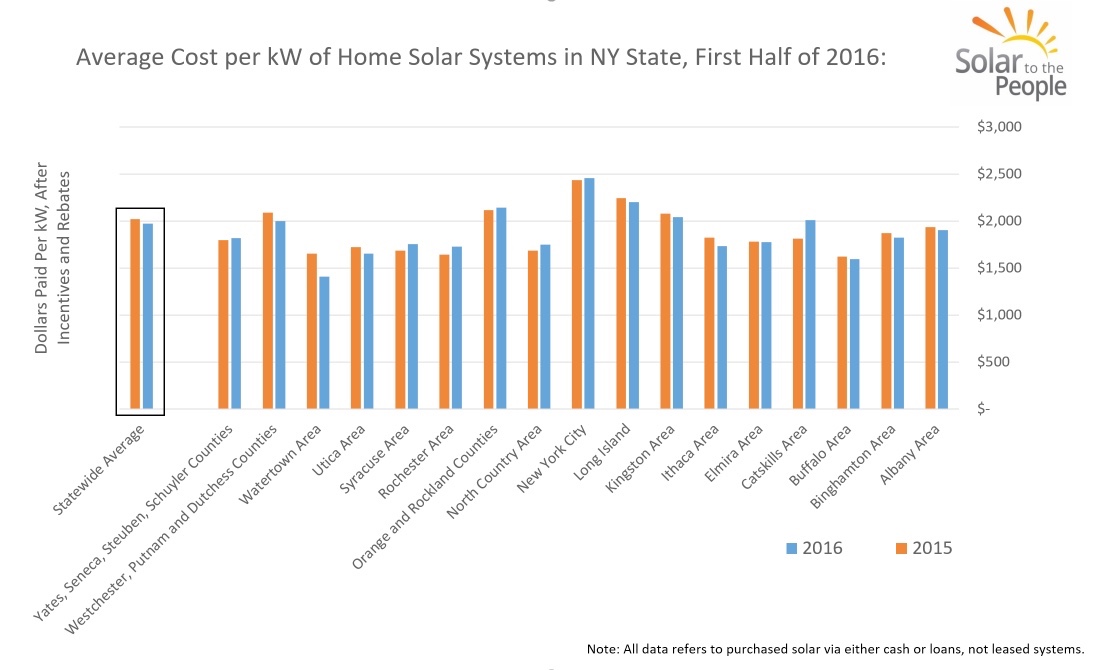

Below are some examples of how your credit would be calculated if you have a solar ppa. In addition to our incentive programs and financing options you may qualify for federal and or new york state tax credits for installing solar at home. Thanks to rebates solar tax credits and exemptions new yorkers could earn back up to 40 on the up front cost of solar. New york state offers several new york city income tax credits that can reduce the amount of new york city income tax you owe.

The great advantages of the solar equipment tax credit are twofold. Detailed information on available incentives and loans for residential customers going solar. New york is a top 10 solar state 1 and for good reason. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000.

As a part of its ambitious reforming the energy vision initiative 2 new york is making solar accessible to households across the empire state. Historic homeownership rehabilitation credit. The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.