Nyserda Solar Tax Credit

Learn how you can benefit from new york s solar incentives rebates tax credits today.

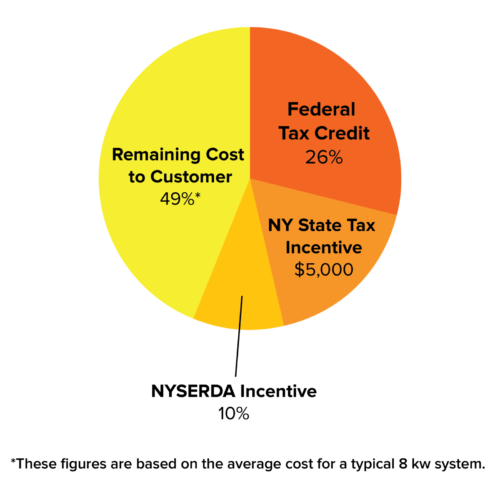

Nyserda solar tax credit. Thanks to rebates solar tax credits and exemptions new yorkers could earn back up to 40 on the up. Below is an overview of the incentives available for installing a solar electric system on a commercial building in ny. In addition to our incentive programs and financing options your business may qualify for federal tax credits for getting solar. The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.

If you re a new york state business owner interested in filing for a tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing. In addition to our incentive programs and financing options you may qualify for federal and or new york state tax credits for installing solar at home. A similar tax credit is available at the state level for systems up to 25 kilowatts in capacity. You are eligible to receive a federal tax credit worth.

For instance if your system costs 15 000 you d be able to take a 3 750 tax credit on your state taxes. New york s residential solar tax credit is equal to 5 000 or 25 percent of the cost of your solar system whichever is less. 10 in 2022 and beyond. If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

Many of these incentives are tax related and vary from case to case federal. The great advantages of the solar equipment tax credit are twofold. It applies to you even if you went solar with a lease or.